When a market turns bullish, seemingly everything is going up. Profits are everywhere, but what do you do next? Reading the market is hard and deciphering market sympathy from true movers is hard. But, right now, we’re in the midst of a unique market. We know exactly what it wants.

Predicting the market is a fickle game. Trends exist but they are largely reactionary. Everyone understands (mostly) that you can make better decisions with data but nothing is perfect. Financial advisors aren’t correct all the time and even your smartest investor friends (even us!) aren’t right 100% of the time. But, when a market swings into a bullish fervor it seems like nothing can go wrong.

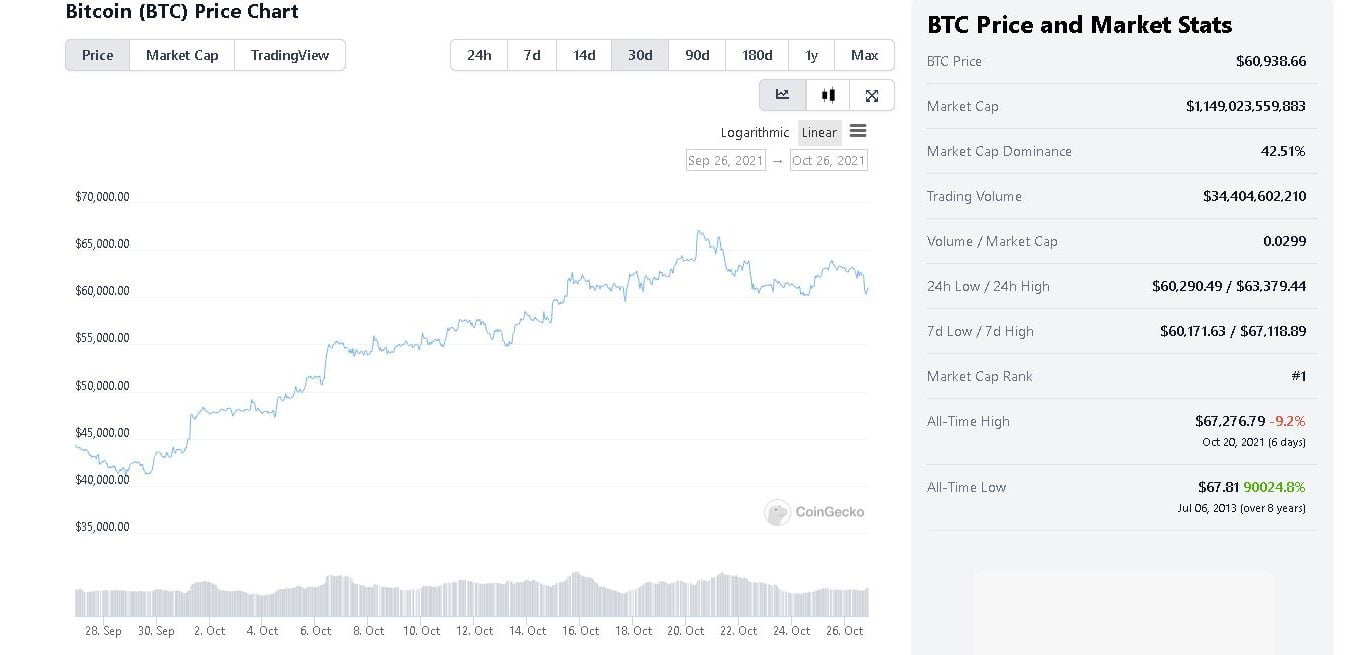

In just the last month Bitcoin has risen from $44k to steadily over $60k. But we’re not after Bitcoin here. It’s an important part of the market, but just like the S&P 500, our goal is to outperform BTC every time. So, in the last 30 days Bitcoin is up a little over 40%. Those are incredible gains, but when you know what the market wants… you can do better.

Since the end of September:

Harmony (ONE) is up 98%

Fantom (FTM) is up 164%

Near Protocol (NEAR) is up 66%

Especially in the last two weeks, AVAX, ATOM, and a number of other major projects have taken off.

So, what do all these major movers have in common? With the market showing rapid growth over the last month, one key trait has allowed projects like these to break out, and it gives us a lot of insight as to what we can expect, within the same market conditions, to happen next. What is that you say?

Functionality

Towards the end of the August we watched Cardano (ADA) skyrocket in anticipation for it’s smart contracts deployment. It was the first “usable” capability the company has put forth. But, as more information was learned about what it actually had to offer, it cooled off and has remained steady and unchanged since (ADA will have it’s day in the sun, but it’s not here yet). Meanwhile, over the same timeframe Solana (SOL) caught fire. Luna caught fire. FTM and Harmony caught fire. Near and Avax caught fire. Apollo commonly calls this the market narrative, and it’s a fitting description. Right now the market wants nothing but functionality.

Since many of these large Level 1 (L1) ecosystem plays have blossomed (and aggressively at that), we can infer a few things.

1. There is a ton of visibility on these projects currently (look up any of the projects mentioned here on Twitter. Most have an almost cult-like following now!)

2. All of these projects have (mostly) fully functional environments and blockchain capabilities that are NOT directly on Ethereum

3. There is a beehive of activity within their ecosystems.

So, if the main chain value skyrockets, what can we infer is next…?

The answer is obvious: Ecosystem plays. While the market remains bullish, we are heavily evaluating and purchasing projects that are functional within any of the aforementioned ecosystems (specifically ONE, SOL, FTM, AVAX) that provides a key feature and capability, or a usable product (gaming). For example; every major L1 needs a DEX. With AVAX skyrocketing, it makes sense that one of its major DEX players, JOE, is skyrocketing as well (up 70% in the last two weeks). Apollo recognized this and grabbed JOE recently.

PolkaDot’s main net launches in a few weeks. Projects within its ecosystem are under our microscope for plays. DEX’s and functioning projects within the ONE ecosystem (XYA, SUSHI, etc.) are on our radar. When you’re out hunting for the next play, you have to know where to look, and we’re confident that we’re looking in the right place. So, until the market shifts, we’ll be looking at:

1. Rolling profits from recent main L1 ecosystem plays into some currently functioning products (DEXs, lending platforms, games, etc.) within SOL, DOT, ATOM, ONE, FTM, LUNA and AVAX (etc.)

2. L1 projects with functional launches happening soon (or speculative ones) – we are always hunting across social media and research sites for projects. Most them are garbage shilled projects, but every so often we are reminded of a project that may have snuck out of our focus

3. Specifically, we’re closely watching the ONE ecosystem. It’s Ethereum scalability and interfacing is terrific and it’s still really new, meaning that despite ONE’s price hike recently, the ecosystem is just starting to grow.

So – when we’re out hunting for our next plays we’ll be digging into these recent movers – ONE, AVAX, FTM, and others, to see what functional projects exist (and we’ll write about them too) or are about to launch, and try to get ahead of them. ONE has recently (due to its growth) overtaken the number one position in my portfolio. I believe it has a chance to rival the growth SOL has seen in recent months, so I’m excited to see where it goes.

To get some of these tokens you’ll need to explore “Life outside of CoinBase”. Don’t worry – there are a ton of easy and safe exchanges you can use, or you can add MetaMask to your skill set, and learn how to use DEXs (Decentralized Exchanges) to get some of these products. It can be tricky, but we’re here to help. Reach out to us on Facebook, Twitter, or email if you ever need help.