Convex Finance (CVX) is one of my better performing lower cap alt coins of late. The longer I hold the token the more bullish I become, and the less I want to sell the investment.

What is Curve Finance

Convex Finance (CRX) is a project heavily built into the Curve Finance ecosystem. Curve finance is an automated market maker (AMM) that offers low fees on many major crypto exchange tokens. Curve focuses on stable coins. Imagine you are moving 10 million dollars from USD to the Euro, you will likely face a massive loss in fees from banks. By using Curve, people gain the opportunity to move various dollar-pegged stable coins with minimal fees, which is massively important in crypto. Not every token available to trade is paired with every stable coin, and not every protocol offers lending and yield on all stable coins. Curve has a token, CRV, that is the voting token (governance) for the protocol. Users who provide liquidity gain CRV as a reward giving trading fees back to the LPs (liquidity providers). Since this protocol functions by tapping into pools of liquidity and cash flow, this is part of what makes fees so minimal to the user.

What is the role of Convex Finance (CVX)

Convex Finance offers a way for CRV holders to optimize their gains without having to lock the tokens themselves. Convex offers boosted CRV rewards, with staking yields, all with no withdrawal fees. Users can offer LP tokens paired with CRV and stable coins to generate a yield, say 30%. This process gives users trading fees in CVX rewards, airdrops, and a 10% share of the platforms CRV earnings[1]. The user can then take the yield of CVX and stake that for an additional 20-30% yield. These two yields can essentially stack, offering a very lucrative scenario for early adopters. Users who do not wish to risk the LP impermanent loss can simply stake CVX token for 20-30% yield. Users can additionally lock CVX for 16 weeks to gain platform fees and governance voting rights.

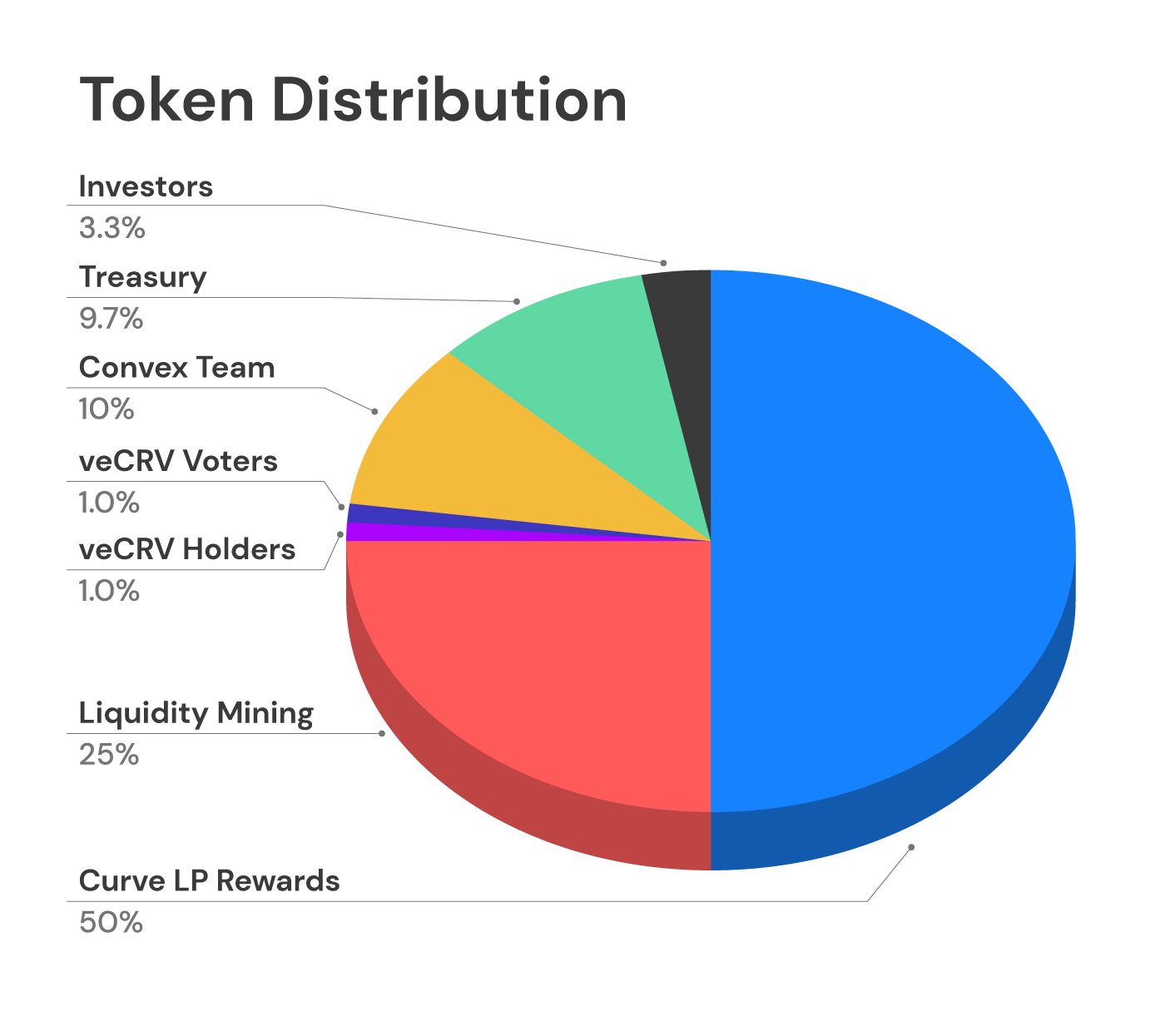

Tokenomics

The token allocation for Convex is visible in the image below. I have noticed that projects I find myself attracted to as an investor have around 50% of the allocation reserved for rewards to the user. Convex has another 25% for liquidity providers and almost 10% to the treasury. The treasury is important because these funds are reserved for ecosystem growth and project marketing etc. Since the allocation for early private investors is so low, the price dumps we normally see from venture capitalists will be minimal. The team only owning 10% is another great sign, these are ideal token allocations.

I first bought into CVX at around 6$ during the bearish trend in the late summer. I was attracted to CVX because it was attached to a popular protocol in Curve, offering stacking yields, and boasted an impressive total-value locked. This is a great ratio to look at when investigating if a project is over or undervalued.

My Thesis

Since I moved into CVX around a $140million market cap, I have made substantial gains. I recently took out my initial investment around 24$ (4x) and hope to ride this wave much higher. I bought CVX using Uniswap with my Metamask wallet. My thought process when I bought into Convex was its pairing with Curve which I believe the institutional investor will be drawn to. Bank of America pointed this out recently stating that investors could 4x bond returns by using the protocol with minimal downside. The second thing that attracted me to the protocol was the initial token allocation. Reserving such a large percentage (75% in total) to protocol rewards is outstanding for investors and users alike.

Perhaps the biggest indicator for me was the fact that while sitting around a 100-million-dollar market cap, CVX had one of the highest total-value locked to market cap ratios I have seen. As mentioned previously, this is an important metric because the lower the ratio, the higher the value should be theoretically. The almighty AAVE has a TVL ratio of .21 today, this number is derived from the market cap divided by the total value locked. CVX has a 3.5x more favorable ratio (until recently it was as much as 7-8x). If the market continues at this bullish pace, CVX could easily 4-7x from here (but who knows). As always do your own research and stay safe out there.

[1] https://docs.convexfinance.com/convexfinance/guides/depositing/crv