Avalanche is a promising emerging leader for the future of smart contract networks. This article gives the full picture on the token economics of AVAX, the Avalanche Network token.

Avalanche Recap

For a refresher on Avalanche, check out our article [here]. When researching Avalanche, it should be compared to Ethereum (the leader for smart contracts) in every way possible. Avalanche is also a layer-1 smart contract-based network. Avalanche is already proof-of-stake which cuts down on energy consumption while rewarding users, Ethereum is still proof-of-work. The Avalanche network is immediately Ethereum compatible, which allows users like myself, and many others to integrate Metamask, and use familiar swapping/defi applications for trading and more. Avalanche has grown substantially in the past year as well, and the AVAX token is now available for easy purchasing in the Americas.

AVAX is on Coinbase, Binance US, and many other popular exchanges that allow American users. With this hurdle out of the way, AVAX can focus on growing the network and incentivizing developers to build and stay building on the protocol. Avalanche already has AAVE integration, Chain Link, USDC/Tether, and the other majors of the crypto market. Based on how many articles we have written about the protocol and underlying projects, it is clear that Coinbusters has a bias for the network & token, but why?

The Subnet Incentive

For a refresher on subnets, check out our article [this way]. Essentially, Ethereum suffers with the ability to scale alongside the tremendous growth in interest the network has received. When Ethereum has high traffic, the network is nearly unusable. High fees, unreliable transactions, and slow speeds ruin the user experience, especially during heated upward markets when users really want those transactions to work. Avalanche was created from the ground up with a solution in mind, Subnets.

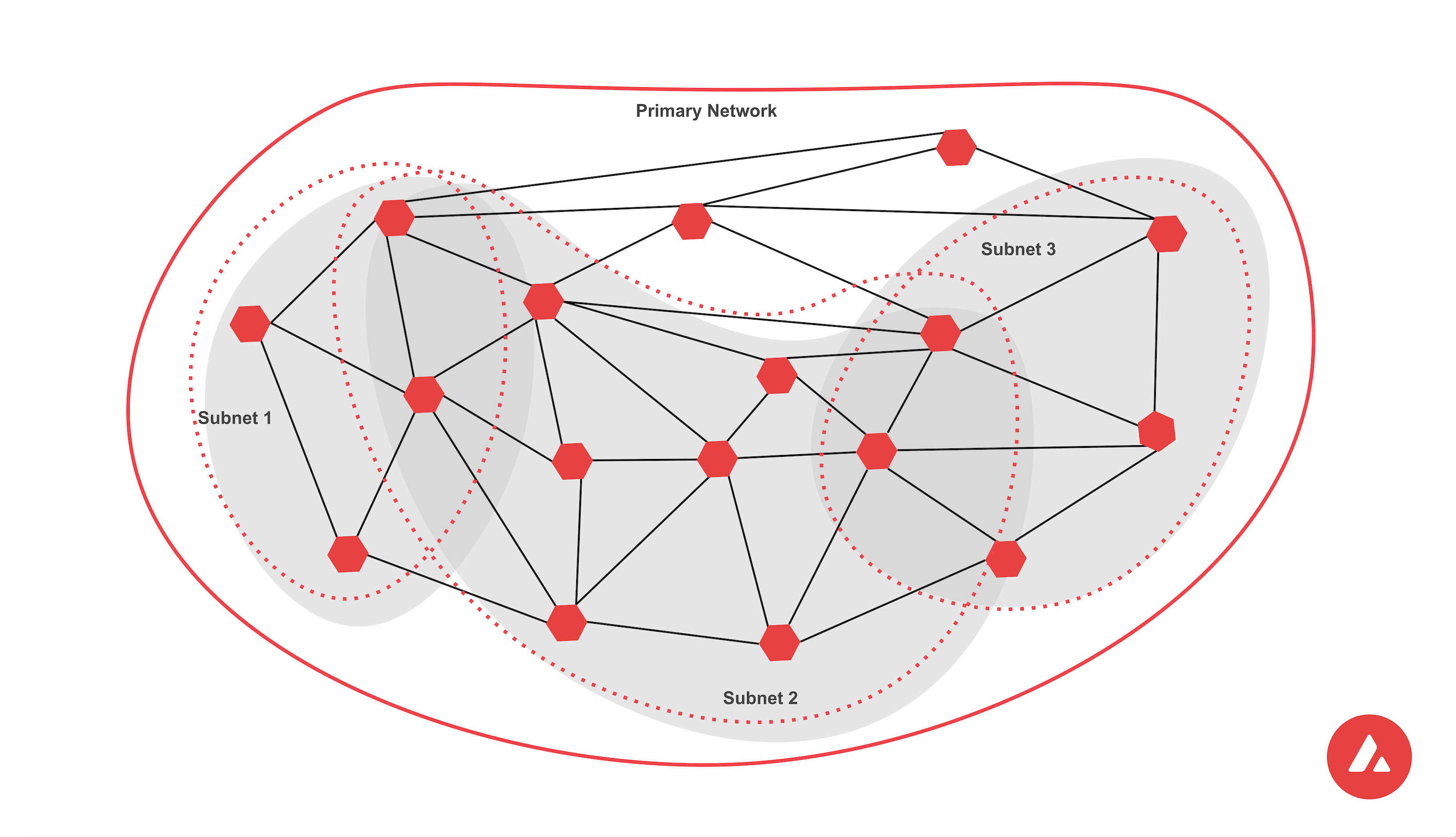

Subnets work by allowing Avalanche validators to focus on specific transaction types or ecosystems. In order to participate, validators must have the minimum stake for the AVAX token, they must assist in validating the main Avalanche network too. A minimum of 2,000 AVAX is needed to help secure the network through validation, today this is around 50,000$. These tokens are locked into the protocol taking some supply off of the network for immediate trade, as usual less supply lends itself to higher prices in many situations. Subnets add an additional incentive for token locking.

The primary Avalanche network itself is comprised of its own unique Subnet. This network is comprised of the three built in blockchains that Avalanche provides, the Platform, Contract, and Exchange chains. Since Subnets do not share execution space, storage, or networking efforts, this allows Avalanche to scale up more easily than its competitors [1]. Subnets also allow for the creation of unique and independent blockchains, native tokens, and economic structures. Avalanche is ahead of the game with regulatory concerns since they have added the ability to request certain requirements from validators for particular Subnets.

From the documentation:

Some examples of requirements include:

- Validators must be located in a given country

- Validators must pass a KYC/AML checks

- Validators must hold a certain license

(To be abundantly clear, the above examples are just that: examples. These requirements do not apply to the Avalanche Primary Network.)

This framework allows all types of prospective future developments to adapt to regulatory compliance or concerns proactively or reactively. Another benefit of the subnet system is that validators only need to participate in the blockchains they are interested in. Since a minimum of 5 validators is suggested for Avalanche, typically at least 10,000 AVAX would need to be locked to run a Subnet on the network.

The incentive for running a subnet is AVAX reward tokens along with the native tokens created by the blockchains the subnet also validates for. A prime example of a Subnet project on Avalanche is Defi Kingdoms, you can check out the project >>>>> [DFK]. Through a customized Subnet, DFK was able to integrate from the Harmony Network, to the Avalanche Network additionally. The newly created DFK chain is the result, faster, more secure, and more customizable.

AVAX Tokenomics

Now that the importance of Subnets has been highlighted, this brings us to the best part, is AVAX a promising long-term investment in our opinion? Do remember none of this is financial advice, we formulate our opinions through our own research and analysis, all readers should do the same! AVAX tokens are used much like ETH in that they are required to transact on the network as gas fees. All transaction fees are burned permanently from the total supply, a modified version of the Ethereum EIP-1559 upgrade. Since 2,000 AVAX is needed to validate for staking rewards, and a likely 10,000 minimum has been suggested for each subnet, one can assume that with increasing demand, more validators will come about.

Each new validator removes some AVAX from the tradable supply, more interesting applications and chains built on the overall network should increase the demand for Subnets. DFK has proven that subnets are quite effective, the transactions are immensely cheap and efficient, users can open the main website and switch between chains seamlessly. The key that many Networks fail to recognize is that the underlying network token needs a use case or utility. AVAX is the basic unit of account of the entirety of the network [2]. Since AVAX has a capped supply, and more tokens are locked/burned the token will become scarcer.

Avalanche rewards validators proportionally for their efforts. More AVAX locked=greater rewards. Longer lock periods=greater rewards. Validators that have high uptime percentages and percentages of correct transactions are rewarded the most. AVAX is required to vote on future changes of the AVAX network as a whole, creating a leaderless economy run by the validators. AVAX avoids spamming by implementing a proof-of-work puzzle the more times a single entity commits the same transaction. This allows for AVAX fees to start of extremely cheap, but penalize spammers with increasing fee costs.

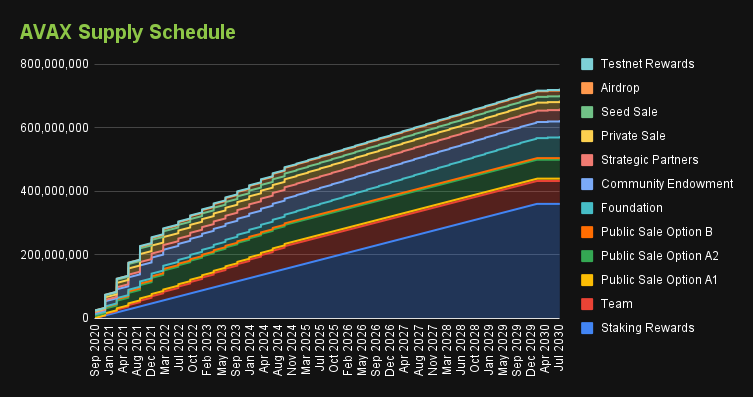

With almost 70% of the total supply released, and a slow-release schedule, sell pressure will likely remain lower than the more aggressive token unlocks we normally see. Around 65% of the total supply were reserved for airdrops and token rewards. Most vesting schedules are completed for the early investors who likely sold, this further reduces massive future sell offs. Combine all of the above and you have a very well-thought out economic structure.

The token ecosystem rewards developers, validators, and investors within the intricate and dynamic system. AVAX achieves a high-likelihood of future success from our research and analysis. We give AVAX a 9/10 only suffering from emission/inflation rates. We also hold the token within our portfolio and have for well over a year (for transparency). Please remember to do your own research, and stay safe out there!