It may seem natural to “sell” when the markets start turning red. “Covering your losses”. Part of the reason we advocate for smart plays is that when you have strategic investments, you can typically ride out downcycles. Even better – if you look for projects that have been disproportionately killed you can find some real bargains. We call this “Stalking your plays”.

Cryptocurrency Cycles

Just about everyone that hasn’t weathered the many crypto crashes/drops/winters will struggle. We always try to be “honest” about the projects that interest us – keeping emotion out of buying, etc. If a project is good we will treat it as such, until it isn’t.

In cycles like the current one it can be easy to not see the forest through the trees.

Don’t forget that not even four years ago Bitcoin was 1/10th its current value. It has decreased in value recently, sure. But have you looked at the stock market as of late, too? Everything is ugly. Wars, COVID and everything in between impact crypto just like other major markets. The long term trend in the market is still overwhelmingly bullish and the news continues to be littered with major large institutions investing further and further into the space. If you view the long term as bullish, you’ll fiend for market cycles like the one we are in currently. This is where you get the best bargains by stalking your plays.

In nearly every article we publish on here we identify market narratives; the areas in crypto we believe people are most interested in, backed by data. Within these narratives are market leaders and these comprise most of our personal holdings. Some plays are riskier than others and not everyone will wholly share our views, for sure. Regardless of this, when the market moves rapidly we have a short list of projects we are looking to accumulate or get out of quickly. In the current bear market climate this is almost entirely about asset acquisition.

Stalking

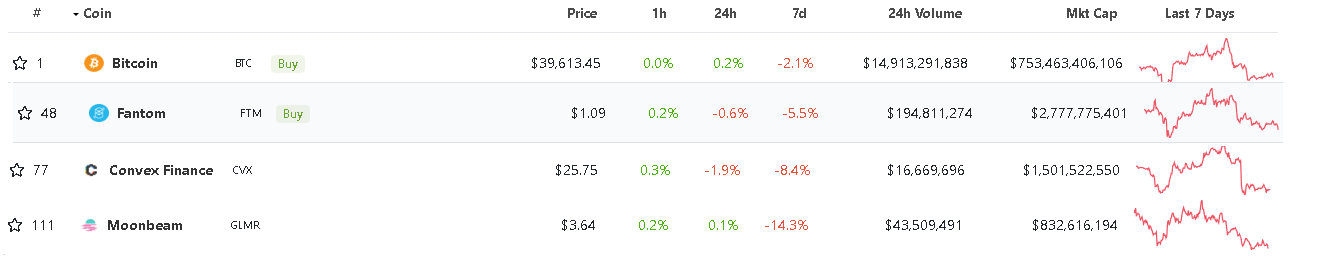

One of the most predictable things in cryptocurrency across the board is that when things move up or down too quickly they almost always correct right after. On weeks where Bitcoin (etc.) may have a sharp drop due to liquidations or large sells, it’s very common for other projects to follow suit, sometimes violently overshooting the market change itself. If the project is on our list and we see it drop significantly more than other players in the space, this is a huge buy signal for us. One of the quickest and easiest ways to do this is to simply compare the 7 day percentage change in price between Bitcoin and the project you’re looking at. If the project is established and not a very small/new project, they’ll generally correlate with Bitcoin movements to a high degree (unless a major announcement, etc. has happened). If you identify a project that moved much more than Bitcoin and you also notice that the overall price of the asset has seemingly (for no reason) tanked in the last month or so – it’s a pretty obvious sign.

Here’s what I’m stalking currently. Fantom, Convex Finance and Moonbeam are all incredible products. In the case of Fantom and Moonbeam, their networks are growing rapidly and this is even “with” the recent significant price drops. Within the last month Moonbeam was nearing $6 and Fantom was >$1.70. Convex Finance is one of the biggest and most important players in all of DeFi. If anything Convex Finance is becoming more and more important as Ethereum gas fees continue to drop (making the network more usable). To me, all of these are projects I’d enjoy having in my portfolio. When these projects drop low like this I accumulate… just a little bit. I am continuing to watch these ones very closely because I feel that they are undervalued. If the price drops more, I’ll buy more. The reason for this is that when the market pumps again undervalued projects are more likely to overcorrect in the upwards direction.

There are many more projects out there that I’m stalking. When there is market churn you need to be identifying projects you have a long term bullish outlook on and checking to see if you can steal a bargain price. I’m willing to wait for the market to correct while great projects keep delivering great products. Stay safe out there!